Collage and pictures: www.zougla.gr

TT Hellenic Postbank has always been synonymous with savings for generations of Greeks. However, after the recent arrest warrants, the bank’s glamour has faded.

TT Hellenic Postbank was founded in 1900 on the island of Crete at the time when it was not yet part of Greece. In 1915, a savings department was established and TT Hellenic Postbank started operating in Greece. It continued to operate during the German occupation, and its deposits reached 21 billion drachmas in the 1970s, or 31% of Greek savings.

Becoming a bank

In 2002, TT Hellenic Postbank expanded its operations and became a bank – it started providing loans to customers who are not civil servants. In 2006, it was listed on the Athens Stock Exchange and included in the list of companies for privatization. Since then, things began to escalate against the background of employees’ disagreement with privatization. In 2009, the bank started issuing consumer loans of up to 5,000 euro against values - something which gave rise to a lot of discussions, and TT Hellenic Postbank was even considered a pawnshop at the time.

In 2008, Angelos Filipidis headed TT Hellenic Postbank and changed everything - from the bank’s logo to its corporate identity. The motto at the time was "easy and fair." Two years later, when bankruptcy threatened the country, TT Hellenic Postbank was the first state-owned bank which bought CDS risk premium on Greek bonds. At the time Filipidis said: "Our job is to buy CDS in the summer, for example, when no one buys them, so that we can be world leaders in terms of CDS, like no other Greek bank... In this way we will be able to intervene and defeat speculators.”

In December 2011, TT Hellenic Postbank acquired Tbank (former Aspis) and its deposits and loans were transferred to TT Hellenic Postbank. The acquisition of the bank by Eurobank Ergasias was finalized in late 2013.

A victim of the clientelist country

The market claims that TT Hellenic Postbank is a victim of the clientelist country, since the acquisition of Tbank and cuts in bonds have created a gap amounting to 3.5 billion euro. During the period 2007 – 2012, the number of employees grew rapidly - from 1,300 in 2007 to 3,000 in 2012. About 700 of these employees came from the acquisition of Tbank.

Angelos Filipidis’s enemies also claim that he hired more than 500 people through 2 different post competitions in 2008. Clientelist times have also resulted in the increase of the number of managers from 30 to 100.

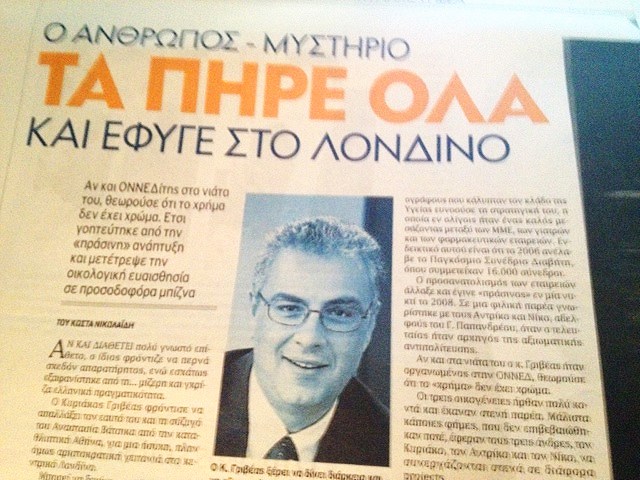

It is no secret that the expansion of TT Hellenic Postbank towards banking activities enabled the then political head of the bank to request the provision of maritime loans or bonds to risky companies. One of these included the bond loan to the company Griveas.

The consequences are known: TT Hellenic Postbank was loaded with risk customers, who, according to the information, did not pay their loans and this led to today's revelations.

The report of prosecutor against corruption Popi Papandreou on former president of the bank Angelos Filipidis is indicative. It is related to the marine loans given by TT Hellenic Postbank during his leadership. The report accuses Filipidis and other bank managers for the participation in frauds which have been committed in complicity, and which have caused damages to the amount of more than 30,000 euro. They are also accused for their involvement in frauds against the state committed in complicity and in particularly aggravating circumstances, which have caused damages to the amount of more than 150,000 euro.

The report’s accusations against Filipidis

The prosecutor's report revealed large sums of money of unknown origin, which have been discovered in six accounts of former president of the bank Angelos Filipidis. From 2008 to 2012, he improved his financial status significantly without evidence of a legitimate source of income.

Filipidis was president of TT Hellenic Postbank from October 2007 to December 2009. At the time, multiple bond loans were issued to various companies. However, the bank had no credit risk regulations, nor appropriate loan assessment and monitoring systems. It did not have a credit management infrastructure either. However, the bank provided funding amounting to millions, ignoring the basic rules of banking practices and violating the acts of the Governor of the Bank of Greece. There are 3 significant cases of very large loans – to Griveas Holding, to ALAPIS and to DEMCO Holding. As a result, the bank suffered damages totalling 346,904,467 euro (208,154,000 euro from the provision of bond loans and 138,750,467 euro in the case of Bestline/HPC). The prosecutor’s report made it clear that Filipidis used his position in order to increase the fortune of third parties via controversial loans, in this way causing damages to the state.

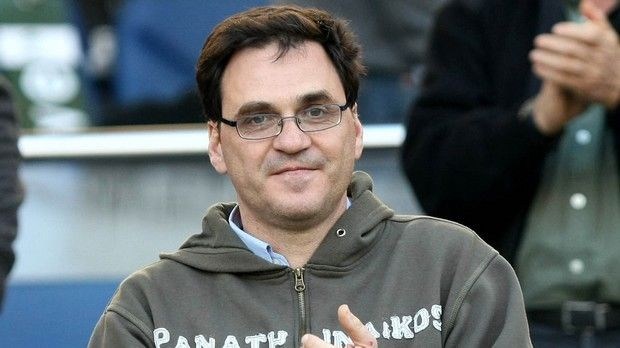

Angelos Filipidis, picture To Vima

Meanwhile Angelos Filipidis has been arrested in Turkey. An international arrest warrant was issued on Saturday morning, which was executed immediately. However, it is not clear why he was in Turkey, since he claimed that he was in the USA and would return in order to testify next week.