Victoria Mindova

Haircutting the face value of Greek government bonds relieved the foreign debt of the country by slightly over 100 billion euro in March 2012. Private investors in the form of banks, insurance companies and investment funds, which had invested in Greek bonds, paid the bill.

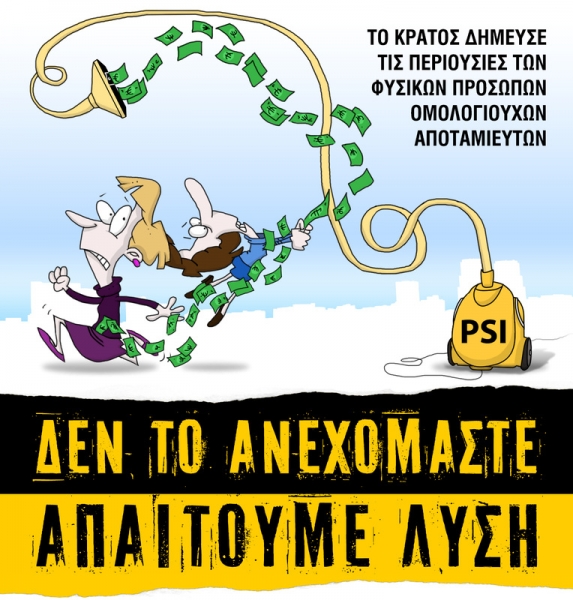

In addition to large financial organizations, over 15 thousand private individuals in Greece had preferred to invest their savings in government bonds before the deepening of the crisis because for many years, it had been assumed to be one of the safest investment moves. After the restructuring of the debt held by private individuals (Private Sector Involvement, PSI), all investors lost 53% of the funds invested in Greek bonds.

Special funds allocated to Greece for the recapitalization of the financial system will compensate the banks. However, individual persons who had invested their funds in government bonds lost irreversibly more than half of their investments. GRReporter contacted the head of the union of private individual investors in government bonds Ioannis Marinopoulos.

Special funds allocated to Greece for the recapitalization of the financial system will compensate the banks. However, individual persons who had invested their funds in government bonds lost irreversibly more than half of their investments. GRReporter contacted the head of the union of private individual investors in government bonds Ioannis Marinopoulos.

In early 2009, the Greek government launched a campaign aimed at private deposits, promoting the investments in government bonds as much safer than bank deposits. "It was shortly after the collapse of Lehman Brothers, at the height of the global financial crisis. There was significant distrust in the stability of the banks. People withdrew their money and put it into government bonds against the government promise of a zero risk and public guarantees. Almost five years later, we see that banks can be almost bankrupt, but deposits have remained untouched. Those of us who trusted the state, however, have lost our savings", said the victim.

New bonds with face value reduced by half have replaced the old ones. The new bonds have different maturities - the payment of bonds that will pay off only 7.5% of the nominal value of the old ones will come first in March 2013, followed by another 7.5% in 2014 and 31.5% of the initial investment will be paid in small parts from 2023 to 2042. "The remaining 53.5% of our money is gone forever," Marinopoulos explains the situation.

He states that at first, the party leaders of the coalition government had pledged to recover the damages private individuals suffered because of the PSI but like many other similar situations, politicians do not remember today any of the election promises. "They made us a lot of promises that we would be compensated in some way, but it has turned out that they lied. We (the victims) voted in the last elections for those who had promised us that they would find a solution to the problem, but over six months have already passed and there is no result yet".

Ioannis Marinopoulos stresses that the government is trying to restore to a certain degree the damage due to the PSI but these efforts are directed at saving only the banks. The government is not only creating a lifebelt for the banking system through the financial stability fund but it is also providing banks with 30-year tax breaks as compensation for the losses due to the haircut of the government bonds.

One of the biggest problems for private individuals is that the majority of the funds the people can obtain from the newly issued bonds is "blocked" for a period of 20 or even 30 years. "Some of our members are 80 years old. They have invested their life savings in government bonds. The government has reduced them by half and deferred their payment from 2015 to 2042, when many of the present investors will not be alive".One of the biggest problems for private individuals is that the majority of the funds the people can obtain from the newly issued bonds is "blocked" for a period of 20 or even 30 years. "Some of our members are 80 years old. They have invested their life savings in government bonds. The government has reduced them by half and deferred their payment from 2015 to 2042, when many of the present investors will not be alive".

Individual persons held a total of about 2.3 billion euro in government bonds. This amount is divided among over 15 thousand people. Some of these bonds were purchased in the primary market, others in the secondary one and the third group was given as payments because the state had no funds available to settle with various members and organizations. Currently, citizens want the government to assist them and exchange the long-term bonds with securities having earlier maturity. "Ordinary people are not able to wait 30 years to be paid their money. Banks are large institutions that operate with a variety of financial tools and they can wait for the payment of the full value of the bonds. It is not the same with individual persons. On the other hand, if we want to sell now, we will lose even more because the market value is about 20% of the face value".

Marinopoulos says that a large number of the members of his union are unemployed or facing serious difficulties in meeting their financial obligations. The other major part consists of pensioners who have invested the little savings they had into an option, which was "safer" than bank deposits. Now, the people need free funds, which the new haircut bonds maturing in ten years is blocking in their case. "You understand that when the time comes to pay the funds remaining after the haircut it will be too late for many people", concludes the head of the union.