collage www.bnr.bg

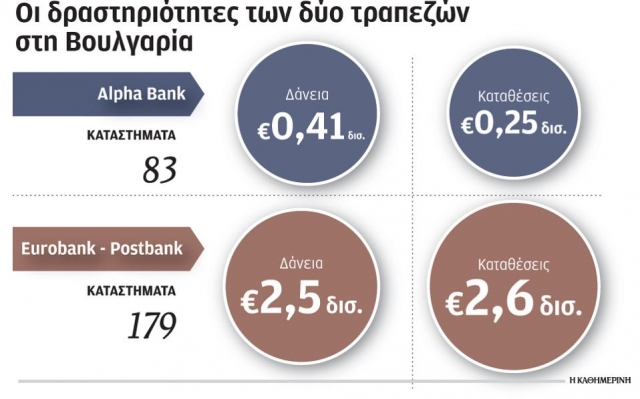

Alpha Bank's Management Board met late in the afternoon yesterday, and approved the sale of its 83-branch network in Bulgaria to Postbank, owned by the Greek Eurobank. The deal will cost a symbolic one euro and is part of the restructuring commitments of the Greek banks before the European Commission. In Bulgaria, Postbank owns €3 billion worth of assets, €2.5 billion worth of loans, € 2.6 billion worth of deposits, and a network of 179 branches.

According to sources from Alpha Bank, the sale of its Bulgarian operation will save resources and free up liquidity in the order of over €100 million. It holds 2.5% of loans and 1.0% of deposits on the Bulgarian banking market and therefore had limited prospects. According to Eurobank sources, the deal is part of the restructuring plans of both banks approved in 2014 by EC's competent directorate. They envisage the concentration of activities on key markets. When the transaction is completed, Post Bank will be the fourth largest Bulgarian bank in terms of deposits.

The activities of Greek banks abroad in the coming months will be under the scrutiny of European authorities. Renewed pressure is expected towards drastic reduction, if not complete liquidation of their presence in Southeast Europe. There was such pressure in 2012 as well, when the first recapitalisation took place, but then the banks' managements succeeded in convincing the EC to reconsider. But this time the situation is even harder. As previously announced, the banks will be obliged to recapitalise again because of the sharp deterioration in economic conditions in recent months. The Commission's reasoning is that the Greek banks, provided they are being bailed out for a second time round, are ill-advised to retain their presence abroad, and instead need to free up resources and energy to deal with steep challenges on the domestic market. Therefore, Greek banks risk being forced out of 7 countries (Albania, Bulgaria, Serbia, Romania, Macedonia, Turkey and Cyprus) and thus lose assets worth €79 billion, a loan portfolio worth €45 billion and a network of 2700 branches with 35,000 employees. Thus, they will relinquish investments amounting to almost €10 billion and abolish operations that began as far back as 1994.

Bank officials believe that in the next two years, Greek banks will be most likely asked to let go of their foothold overseas. Yet some are optimistic that they can keep their outlets in markets where they have a strong presence. The final strategy will be drawn up together with the EC and will depend on the ultimate capital needs specified by the diagnostic study. The latter will be carried out by the ECB this fall. Bank recapitalisation is expected by the year-end. Tackling bad loans is crucial, as well as deferred taxes.

According to analysts, the new recapitalisation will follow the 2012 model, that is, bailing out the more robust banks and liquidation of the unsustainable ones. The agreement provides resources worth €25 billion for the process. The national legislation should immediately incorporate the 2014 Community directive on bank consolidation. The new directive recommends that 8% of the needs of a bank be met through a reduction of its own liabilities (bail in) in the following order: shareholders, bondholders, and if necessary - depositors (for amounts exceeding €100,000). Banking sources believe, however, that there will be no haircut even of non-guaranteed deposits.