Photo: Ethnos

A day after the announcement of the results of the second elections in Greece, the Public Debt Management Agency held an auction for quarterly government bills and raised 1.3 billion euro. The interest rate on securities was 4.31%, which is slightly lower than in the previous auction of the same type of bills in May, when it was 4.34%. The bids covered the demand 2.19 times and the Ministry of Finance will accept non-competitive bids up to 300 million euro until midnight on 21 June this year.

Meanwhile, it has become clear that Greece will receive one billion euro in financial aid by the end of the month. The information referred to sources from Brussels and was released by the German news agency DPA, quoted by Imerisia. In May, the European Financial Stability Facility approved a tranche of 5.2 billion euro for Greece. Only 4.2 billion euro was paid to Greece then and the remainder will be transferred after the formation of a government.

The representative of the European Commission Amadeu Altafaj said that the members of the supervisory Troika of the European Commission, the European Central Bank and the International Monetary Fund will return to Athens immediately after the formation of the government. "Greece’s European partners may agree on concessions to the country’s austerity measures and reforms but they will not agree to substantially alter them. It would send a wrong message if we made concessions without a good reason," Eurogroup head Jean-Claude Juncker told ZDF. He is clear that the memorandum of financial assistance may be renegotiated or in some cases improved, but the Greeks cannot expect major changes in the bailout agreement.

The difficulty of forming a homogeneous government after the results of Sunday's election is the first criteria on whether Greece can achieve medium-term stability. Holger Schmieding, senior economist at Berengerg Bank, believes that the chances of Greece exiting the euro area by the end of the year are 75%. Experts of Citigroup Global Markets are slightly more optimistic and their analyses show that the probability of Greece leaving the euro area in the next 12-18 months has dropped from 75% to 50%. Their analysis states that the little opportunity for manoeuvring in renegotiating the conditions of the loan gives rise to a possible Grexit. The strong opposition formed by left radicals after 17 June is also playing a destabilizing role in the eyes of the financiers of the European future of the country. The risk of Greece exiting the single currency could be receding but it is still probable, analysts say.

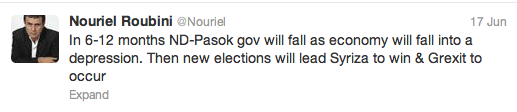

The same is the opinion of world-known economist Nouriel Roubini-Dr. Doom. He has already given up writing long analyses on the topic of the Greek debt crisis and the euro area. Instead, he has been posting only short apocalyptic messages in his personal profile on Twitter, threatening a catastrophe for Greece as he sees it:

Currently, the "euro-drachma" dilemma remains somewhat in the background and markets are optimistic about a government led by New Democracy. The positive growth on the Athens Stock Exchange continued for a second day and reached 3.7% at 5 pm on Tuesday whereas the turnover exceeded 67 million euro. However, the shadow of the crisis is still looming and BlackRock’s report states that in the next three years, Greek banks will lose about 30 billion euro due to non-payment of loans. The recession and bankruptcies in the private sector, combined with the deep indebtedness of small and medium companies in Greece, together with the loans to individuals will put the local financial sector to a new test.