Victoria Mindova

Bulgaria continues to leave Greece behind in the statistics for attracting foreign direct investment, according to the annual report of the United Nations Conference on Trade and Development. Data for 2011 show that among 177 countries in the world, Bulgaria is the 49th country as regards attractiveness for investment, whereas its southern neighbour is ten places behind it. However, as far as market activity and infrastructure are concerned, Greece is significantly ahead of Bulgaria. In market activity, Greece is ranked 75th and Bulgaria is 91st. Under the indicator for developed and efficient infrastructure, the Mediterranean country is 19th and Bulgaria is 40th. The first five countries preferred by investors are China, USA, India, Korea and Australia.

Globally, foreign direct investment has increased compared to 2010. Its total volume in the global economy reached 1.5 trillion US dollars last year. Foreign direct investment inflows in developed countries have increased by 21% to reach 748 billion euro. Developing countries have also recorded an increased interest by foreign investors and there was an 11% jump in 2011 compared to the previous year. Global production of multinational corporations has also increased, said Marina Papanasthasiou from the Business University of Copenhagen, who is also the official representative of the United Nations Conference on Trade and Development in Greece.

She presented, in Athens, data from the international study on the movement of foreign direct investment, stressing that its volume is expected to increase in 2012 and reach 1.6 trillion US dollars. Developing countries are no longer only an attractive destination for investment, but they themselves have become investors with a 30% share of total foreign direct investment in the world. The new investment players are mainly state-owned enterprises in the field of energy, which, although representing only 1% of investor interest, contribute 11% to global foreign direct investment.

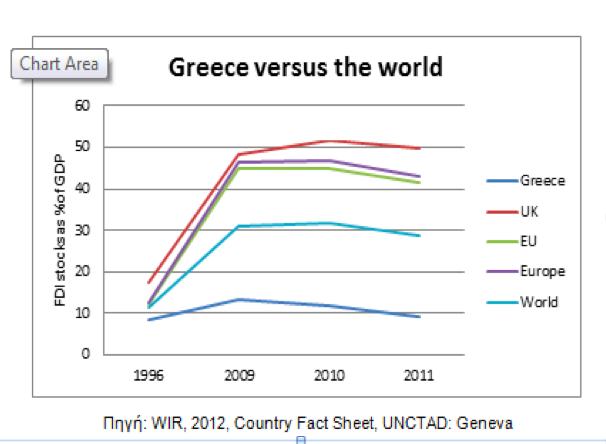

The contribution of foreign direct investment to GDP in Greece has been steadily growing since 1996. The same is the trend worldwide. The problem is that the level of growth of foreign investment in Greece remains significantly lower compared with European and world levels.

Marina Papanasthasiou said that competitiveness, as a function of labour costs, is crucial for attracting foreign direct investment. "Therefore, I do not think focusing on salaries' reduction will make Greece more attractive to investors," she insisted in the context of the measures pro-memorandum governments took in the past year. She stressed that it is very important to focus on structural reforms, deregulation of the market and on the reduction of the public sector rather than for the Troika and the new government to focus on the reduction of salaries in the private sector.