Pictures: www.imerisia.gr

The government is trying to "unlock" the plan for the exploitation of the vast property of the state, which is unused, although it could generate revenues. The portfolio of the Company for State Property and the Agency for Private Public Property consists of more than 70,000 unused properties. A plan familiar from the past is being suggested – popular Balladur Bonds, which were applied in France 20 years ago by the then Prime Minister Eduard Balladur.

Eduard Balladur

This plan, if approved, will apply to Greek conditions and will apply only to public property, and not to state holdings in companies such as the National Power Corporation DEI, for example. Balladur bonds refer to French companies which have been privatized through the stock exchange.

According to information, the following model is being examined for Greece:

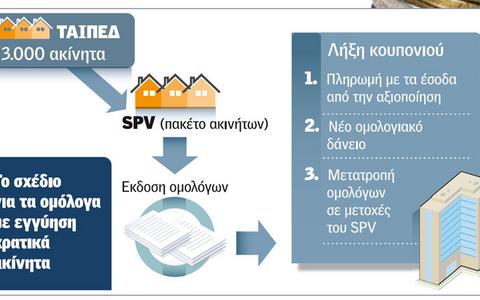

In the first scenario, the state will create a package of properties, initially 3,000, under the control of the Agency for Private Public Property. A Special Purpose Vehicle – SPV will be established, bonds will be issued, which will be available for purchase by both Greeks and foreigners, or small investors, and which will have state property as collateral. When they expire (they will have an annual return of more than 7% in order to be attractive), if their holders are not paid, they will have rights on the property. It is expected that this opportunity may be questioned.

The second and more likely scenario envisages the creation of an SPV, in which public properties will be submitted. Bonds that can be converted into equity will be issued, but the procedure will take place outside the stock exchange (which distinguishes them from Balladur Bonds). In practice, this is a bond loan with a high interest rate.

In the second case, if the bonds are not paid after their expiration, the SPV will proceed to a new bond loan. Bonds could be converted into shares of the public company.

In order for this plan to succeed, the best use of properties needs to be ensured. If, for example, the terrain in Afantou, Rhodes is included in the SPV, for which many competitions have been carried out, an investor needs to be found in advance in order to pay a significant amount as an annual rent, as well as a percentage of the profit from the exploitation of the terrain.

Another important prerequisite is that the profit from the exploitation of the property should go to service the bonds.

Reportedly, during the first phase, Greece will be able to issue Balladur Bonds worth at least 1 billion euro. Given that public property is calculated as a value per 60-70% of GDP, i.e. 120-140 billion euro, bonds which will bring the state treasury 3-5 billion euro or more could be issued.

- This could be of significant help because:

- It will fill part of the "gap" in public debt.

- It will be related to the development, i.e. some or all revenue bonds will be aimed at supporting development activities that will create thousands of jobs.

- It will encourage Greek and foreign investors to invest. They will be secured, since in the case of non-payment, they will become shareholders in the SPV.

- It will cover future financial gaps so that Greece could avoid a new loan from the Troika.

Market experts believe that the package may include properties such as Afantou, Rhodes, the former royal estate in Tatoi, 500 acres near the Peace and Friendship Stadium, other municipal property, large areas in Vorasm Xanthi, Gournes, Alikes, former Olympic Properties, office buildings, embassies, and agricultural fields.

In 1998, the government of Costas Simitis, together with the then king of the economy Nikos Christodoulakis, planned the issuance of such bonds, based on the French experience in privatization. At the time, the plan also referred to companies that would be privatized through the stock exchange, and was aimed more at small investors. The minimum amount of investment was 100,000 drachmes. It was announced that they would not be subject to taxation and would be introduced as of the beginning of 1999, when in practice the exchange "bubble" began.