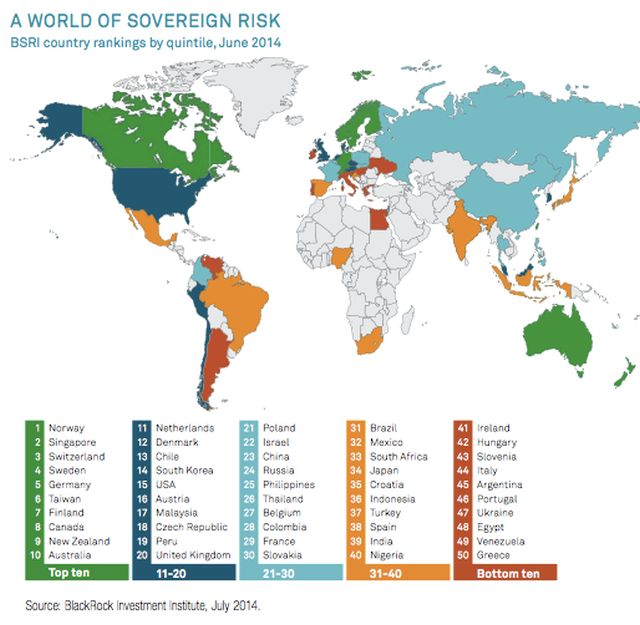

Greece is the country where the probability of bankruptcy is highest according to the Blackrock index based on the fiscal data of the 50 countries included in the ranking of the agency.

According to the bankruptcy risk index, or the Sovereign Risk Index, for the quarter of April-May-June, the period was favourable for developed markets such as Belgium and Britain, which climbed up in the ranking, but the main emerging markets retreated due to political instability and deteriorating economic prospects.

For example, Brazil has dropped four places in the ranking, occupying 31st place among the 50 states observed, which, according to Blackrock, is due to increased levels of short-term debt.

Russia is three positions down to 24th place due to "a weakening of the government efficiency" and worse economic prospects.

Argentina, which is in deadlock because investors refused cutting bonds, retreated one place down to 45th place compared to the previous quarter. Meanwhile, developed economies have benefited from the correction up implemented by the International Monetary Fund in its forecasting for growth.

Belgium moved up four positions to 27th place, the UK – by three positions up to 20th place and the Netherlands – up two positions to 11th place in the ranking.

In the Blackrock list of bankruptcy danger among states, the 1st place is for the country where the risk is lowest, and the last, 50th position, is for the country of highest risk. Thus, the first three places are occupied by Norway, Singapore and Switzerland. At the bottom of the list are Egypt, Venezuela, and the last, 50th place, is for Greece.