Victoria Mindova

More than one billion people in the world use digital technology every day. "We have a digital life. This is our new reality. It requires companies, including banks, to find ways to provide their services to mobile and other digital devices for the convenience of their customers" as stated by Ray Pinaki, senior director for Europe, Middle East and Africa in the company SAP, during the Digital Banking Money Conference 2013 which took place in Athens this week. The company serves more than 100 customers in 27 countries and it has significant experience in the development of integrated digital networks to serve banks and to provide digital banking services.

Pinaki states that 4.5 million people in the Netherlands are using a mobile service to pay their bills. This trend is growing worldwide. Therefore, according to the expert, the digital services offered by banks must constantly evolve and improve to meet the needs of customers.

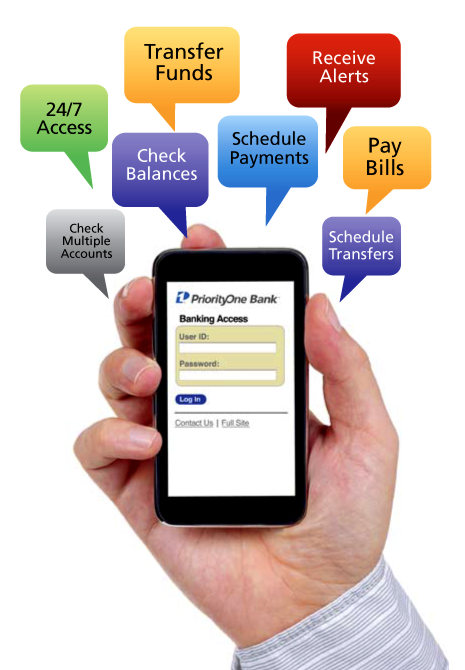

The most common mobile services that IT-specialists offer in connection with the development of digital banking include e-banking, bankers app, mobile banking, security, social media, call centre, ATM/FOS. Unlike the majority of the services, the bankers app helps bankers to easily manage the information related to their customers via the mobile devices (smartphones and tablets) that they are using.

Social media in banking can also play an important role in the development of the market. The company can offer automatic services on the basis of their clients’ status. "If I post something on my Facebook page, the bank can offer insurance for my trip using th e link to the social media," says Pinaki. Social media provide accurate information about users’ needs and desires in real time. This information may favour the banking system, as other commercial companies are already using it.

e link to the social media," says Pinaki. Social media provide accurate information about users’ needs and desires in real time. This information may favour the banking system, as other commercial companies are already using it.

In Greece, 50% of smartphone owners use e-banking as shown by the data of PollFish. Only 30% of them use mobile banking whereas this percentage exceeds 50% in the United States. Seven out of ten users of e-banking do not use banking services on their mobile phone. The majority of those who use mobile banking are called power users. They make more than ten transactions per month using the mobile banking service. "As you can see, although the e-banking service is widespread, the people in Greece still avoid using their mobile phones for banking transactions even though this can greatly facilitate their everyday life," states Yiannis Papadakis, founder of PollFish agency.

Espen Trey, Managing Director of First Data Hellas, is clear that the future of banks lies in mobile technology. "All of us have several credit and debit cards in our wallet," he said, stating that the future of cards like Visa and Master, and even of the e-card for the public transport is for them to be integrated in our mobile phones in digital format.

The specialist believes that businessmen, entrepreneurs and bankers should trigger new trends and enable their customers to make payments and purchases via their mobile phone. In this way, they will give up the old methods of electronic payment and the process of consumption will become easier and faster.

Trey reviewed the methods of payment in Greece and defined credit cards (buy now-pay later) as an obsolete trend. On the other hand, he notes that the crisis in the country has made people more cautious and debit cards are now preferred for purchases to credit cards. Cash payment remains the most popular method of payment in the country although, at the same time, the data shows that electronic purchases are increasing.

The experts are adamant that increased introduction of mobile technology in consumer behaviour will not only facilitate the transactions, but will contribute to combating the informal economy. An 8%  increase in the electronic payments to public and private institutions will increase GDP by 1.4% -1.5% and will significantly contribute to combating the informal economy as stated by Harris Theoharis, head of the revenue agency in Greece.

increase in the electronic payments to public and private institutions will increase GDP by 1.4% -1.5% and will significantly contribute to combating the informal economy as stated by Harris Theoharis, head of the revenue agency in Greece.

According to Athanasthasios Germanis, regional manager of MasterCard Greece, the government should put a ceiling on cash payments to the amount of 40 euro instead of the 500 euro as it is now. "This would be a huge blow to the informal sector, will support the collection of taxes and help the Ministry of Finance monitor between 60% and 70% of the transactions made on the open market in the country," says Germanis.

At present, only 6% - 7% of Greece’s turnover comes from payments via electronic cards. This rate is 40% in the countries of Western Europe. "You see the potential of this market in Greece," states Thassos Panousis, Deputy Manager of Eurobank. The bank represented by Panousis launched the first contactless debit card in July 2012. In December 2012, the bank launched the first contactless credit card and its mini version at the beginning of this year. With it customers can pay directly for products to the amount of 25 euro, without entering the PIN and going through the cash register. There are 45,000 contactless cards in use in Greece at present whereas, by the end of the year, the number of contactless credit and debit cards in use will reach 80,000.