Pictures: www.naftemporiki.gr

The Troika will provide the Ministry of Finance with a lot of alleviations, such as an increase in the duration of the financial year to 15 months, an inclusion of amounts generated from privatisation in revenues, an exclusion of returned taxes from costs and many other measures in order for the Ministry to achieve budget targets and primarily a surplus.

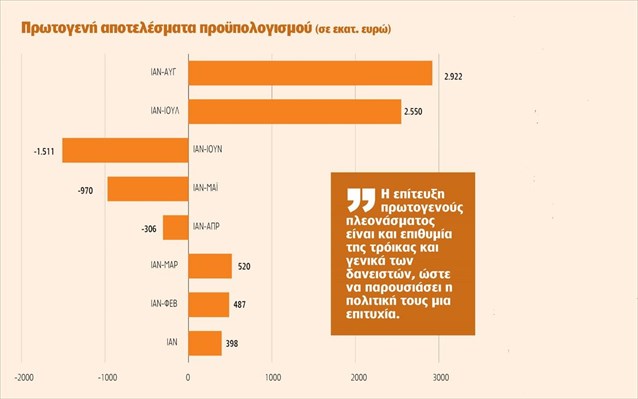

"The Technical Memorandum", which was signed between the government and the Troika last July, determined parameters that will be included in the 2013 budget, as well as in the coming years. It is noted that Eurostat announced a 10% deficit for 2012, while according to the government and the Troika the deficit was 6% of GDP. As for the difference between the data of the Ministry of Finance and the Bank of Greece for the period January-August, they are exceptional, since the analysis of data of both institutions showed a deficit of 3.2 billion euro with payments of expired bonds, or a surplus of 1.4 billion euro, excluding those payments.

However, the problem does not lie there, but in the tendency for the achievement of a surplus at all costs - something that the government wants to go ahead with in order to further reduce debt, according to decisions of Eurogroup of November 2012.

A surplus is something that the Troika and creditors as a whole would like to be achieved too, so that their policy could be presented as successful and convince citizens of the Eurozone that the programme is successful and if new credit is needed it could be passed without serious opposition.

Thus, for the eight months, the Ministry of Finance will maintain costs amounting to 2 billion euro, investment amounts of 1.3 billion euro, and tax returns amounting to 660 million euro, so that a surplus of 1.4 billion euro can be generated, which will have to be maintained if specific costs are not paid by the end of the year. Simultaneously, "the Technical Memorandum" of July will alleviate certain financial arrangements in order to facilitate the achievement of a surplus and improve financial parameters. And in particular, the following:

- Tax refund related to obligations up to September 2012 will not be included in the budget. Fiscal benefits will be significant, since up to August repayment of taxes amounted to 790 million euro. However, this year's budget will include amounts collected from real estate taxes for 2010, 2011 and 2012.

- Revenues from privatisation will also be included.

- Revenues in the budget for 2013 will include revenues from the fifth instalment of the property tax that is paid together with electricity bills, which will be collected until March 2014 - about 350 million euro.

- Government expenditures will not include payments for the support of banks that are part of the strategy of the financial sector.

State companies

The Privatisation Agency will be added to state-owned companies the economic outcomes of which are included in the budget. As stated in the "Technical Memorandum," "State-owned companies will include the Agricultural Insurance Fund, the Centre for control and prevention of disease, the Agency for payment and control of EU programmes, the Hellenic Tourism Organisation, the Athens metro, Greek Defence Systems, The Hellenic Broadcasting Corporation, the State Railways, as well as all related companies for the construction of railways and real estate, the Road Infrastructure Company, the Information Society, the Agency managing development programmes, and the Public Private Property Management Agency.

Fiscal performance (in millions of euro)

Why there is no difference

As to data of the Treasury and the Bank of Greece on the development of the budget in the first eight months of 2013 and induced effects of the differences between them, the central bank said in a statement yesterday that there was no difference between the data of both institutions. The Treasury described parameters on a financial base, while the Bank of Greece - based on cash flows from the state’s accounts.

Parameters that caused the difference include the payment of expired bonds (4.6 billion euro) and return profits from Greek bonds by central banks of the Eurozone amounting to 1.5 billion euro. The Ministry of Finance included the repayment of expired bonds, however, not in the budget, but under a line, while the Bank of Greece described them in cash flows of the state’s accounts.

Returns of profits from bonds were described by the Ministry of Finance, but according to Christos Staikouras, the amount will be deducted, and that is why the surplus of 2.9 billion euro will be reduced to 1.4 billion euro. The Bank of Greece, in turn, will not include the specific parameters (and rightly so).

The Ministry of Finance announced a surplus of 2.9 billion euro, it will take out of it the amount of 1.5 billion euro (profits from Greek bonds) and the surplus will be reduced to 1.4 billion euro. If payments of expired liabilities (4.6 billion euro) are calculated, then a deficit of 3.2 billion euro will arise. The same deficit is calculated by the Bank of Greece, which did not calculate profits from bonds, but added payments of past liabilities.