* Liberalisation of the construction of new hotels in areas such as Attica, eliminating the concept of "market saturation" and changing the provisions for structure works in order for them to facilitate the change in the use of buildings and their conversion into hotels.

* Removing the restrictions on cruises such as the requirement that the ships that set out from a specific port must return to it and others.

* Cancelling the control and approval procedures applied by the state laboratory in terms of detergents.

Regarding the cement market, the OECD report notes that the expensive infrastructure by non-producers increases the price of the product.

For example, the capacity of the silos that store the cement should be minimum 500 tonnes. Ultimately, this means that the high investment cost restricts competition and increases consumer prices.

The report also states that the 2% fee on the retail price of cement collected in favour of the pension fund of the workers in the industry is increasing the end price and brings additional costs to both manufacturers and importers, thus reducing the flexibility of market prices.

Administrative burden amounting to 14 billion euro

At the same time, OECD Secretary-General Angel Gurría and the Greek Minister of Administrative Reform and eGovernment, Kyriakos Mitsotakis, discussed the first results of the OECD survey carried out for 9 months on 13 sectors of the economy.

The OECD had to describe the administrative burden in the legislation.

The aim of this project is to reduce the red tape by 25% by the end of 2013, which is the responsibility of the state under the memorandum.

The value of the administrative burden in Greece costs the GDP 14 billion euro and is the highest in Europe. Reducing it by 25% by 2025 would increase the GDP by 2.4 %. Every year business in Greece is forced to spend more than 2 billion euro to cover expenses caused by bureaucratic obstacles.

The OECD analysts have identified weak points and unnecessary administrative costs incurred by business, which adversely affect both the effective operation of companies and households. It is expected that the reports indicating the necessary changes will be submitted soon.

Recommendations for another debt haircut and for resolving the issue of "bad" loans

In addition, Angel Gurría insisted on immediate intervention to reduce Greece’s sovereign debt by partial forgiveness of the loans granted by the public sector whereas the Minister of Finance, Yiannis Stournaras, mentioned that the discussion on this issue would begin after April 2014.

The OECD has supported the International Monetary Fund which also insists that the European Commission should trigger new measures to reduce the Greek debt.

OECD Secretary-General Angel Gurría said that the longer it takes to find a solution to the debt, the longer it will continue to burden the country and prevent its economic recovery. He added that the high debt is an obstacle to the economy, despite the reforms carried out in the country.

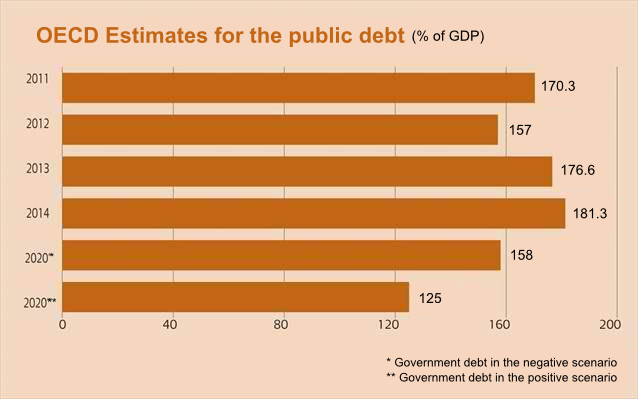

The report by the OECD has estimated that the government debt of Greece in 2014 will increase to 181.3% of GDP from 176.6% this year and it is believed that it will not be viable without additional measures.

Angel Gurría suggested that since the larger part of the debt is already in the public sector, it would bear its burden.

"I know that the sources of loans are mainly public; earlier they came mainly from the private sector whereas they have now turned to the state. And if it is clear that the debt is too high and should be reduced, it is also clear that, at some point, some state institutions will have to take a decision as regards this issue." Angel Gurría said that the two PSI procedures, which had reduced the private sector debt in Greece, had been carried out despite the responses in connection with them.

For his part, Minister of Finance Stournaras stressed that the new changes in the debt based on the decisions of the Eurogroup of November 2012 will start in April 2014 when Eurostat verifies the primary surplus achieved in 2013.

Meanwhile, the OECD report advocates the immediate resolving of the issue of "bad" bank loans which it perceives as a consequence of the crisis.

In this context, it suggests the establishment of the so-called "bad" banks to take over all the "bad" loans, thus improving the balance sheets of the commercial banks.

The report stresses that the idea can be implemented through the creation of "bad" banks to every system bank or by creating a single "bad" bank the liquidation of which should be the responsibility of the state.

The OECD also recommends the following:

* Implementation of reforms.

* Reduction of the administrative burden on businesses.

* Combating tax crimes and improving tax administration.

* Completion of the administrative reform.

*Redirecting the social programmes in order to meet the health care needs and the minimum standard of living of the poor groups of the population.

* Overcoming, by all possible means, the very high rate of unemployment, especially among young people.

Praising the progress of the adjustment programme

In addition to the presentation of the OECD report Secretary-General Angel Gurría expressed satisfaction, praising the efforts of Greece. "You have done an excellent job", Gurría told Greek Prime Minister Antonis Samaras during their meeting in the Presidency.