Photo: kathimerini.gr

2 trillion euro is the loss that the Greeks have suffered because of the decline in real estate prices since the economic crisis in 2008 until today. It is due to the 50% reduction in the prices of all categories of properties but also to the interruption of investments that have been expected to increase their value. The data were presented at yesterday's conference on the real estate market Prodexpo by managing director of the company CBRE Atria that offers services to the sector and Vice-President of the Union of Real Estate Investors Yiannis Perotis. According to him, a large portion of these losses in the property market is due to the wrong fiscal policy that has been recently implemented and that has worsened the already existing negative effects on the market caused by the economic crisis.

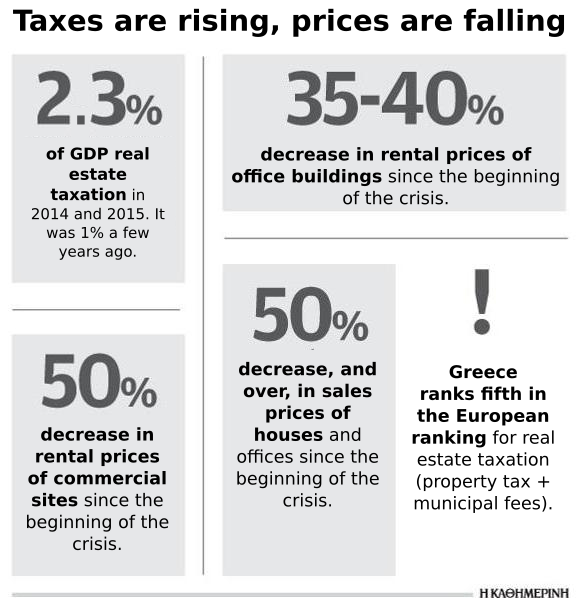

According to Yiannis Ganos, chairman of RICS, in Greece and Cyprus there is already a significant imbalance in real estate taxation since taxes are levied both on the ownership and when it is transferred, in a period of falling prices at that. Thus, in 2014 real estate taxation reached 2.3% of Greek GDP. The same is expected to happen this year too whereas only a few years ago the taxation was in the order of 1% of GDP.

In this regard, Potami MP and former Secretary of State Revenues Harris Teocharis pointed out that today Greece ranks fifth in the EU real estate taxation, while sales prices of houses and offices have decreased by 50% since the beginning of the economic crisis until the present day.

The representatives of the sector argue that, currently the real estate market is under even greater pressure as a result of the uncertainty and lack of liquidity that are due to the capital controls, the yet unaccomplished bank recapitalisation and the lack of confidence in the implementation of the commitments under the new rescue programme. In their words, these factors are preventing new investors from coming to Greece since they are holding the Greek economy "captive".

According to the data presented by Lila Pateraki from the company Zeus Capital Partners, 6 billion euro have been invested in the real estate market in Central and South-Eastern Europe from the beginning of the year until the present day. This amount is expected to reach 10 billion euro by the end of 2015 and Greece will be totally absent from the investor 'map'.

In turn, delegated advisor of the Privatisation Fund Lila Tsitsoyiannopoulou announced the launch of new privatisation tenders for a large number of public properties that are located in tourist destinations across the country. They include a property of 615 acres in Porto Heli, 97,500 square metres of which can be built up with a hotel, golf course and airport. The other properties on this list are in Vartholomio in the western Peloponnese with a building area of 40,736 square metres, in Ierissos, Halkidiki (231 acres with a view to the coastline that is 1.7 km long) and an area of 137 acres with a building area of 62,000 square metres in Agia Triada near Thessaloniki. A privatisation tender will be held for an area of 120 acres in Kriopigi, Halkidiki that has a view to the sea and is 750 metres long.

Tsitsoyiannopoulou also pointed out that, by the end of the first quarter of 2016, the pilot securitisation of future privatisation revenues from a series of state property will be implemented, as specified in the memorandum signed with creditors. Regarding the privatisation of the area in the suburb of Eliniko where the old Athens airport was located, she said the goal is to overcome all social and political obstacles to its implementation by the end of 2016.